Breaking Up with ChatGPT (It's Not Me, It's You): AI Series, Part 2

Aug 22, 2025

Yesterday, during my daily LinkedIn doom-scroll session, I noticed increasing frustration from commenters pointing out the heavy reliance that many LinkedIn Influencers - "Linfluencers"...? (is that even a term - it probably should be if not) - have on formulaic ChatGPT write-ups for their posts.

It's something I've noticed more recently, especially with the release of ChatGPT-5. I was, admittedly, using it a lot myself - mostly for strategic marketing and content purposes, but always within a critical framework since I recognize its limitations.

However, I've now reached a point where I've pretty much ceased using it, especially since I noticed it's becoming neurotic and needy, let alone riddled with mistakes and circular reasoning.

In my last post, "Start with Why? Or just start with ChatGPT...", I talked about the right way to work with AI - maintaining critical conversation rather than blind reliance. Well now, I'm ditching it - ChatGPT specifically and here's why...

The Formula Factory

ChatGPT has developed a predictable formula that's becoming increasingly tedious:

- Em dashes everywhere

- Gratuitous emoji usage

- Endless rhetorical questions

- The "This isn't X - it's Y" formula (definition by negation used constantly)

- Copy-paste responses that flood LinkedIn feeds

I suspect ChatGPT deliberately avoids giving final answers when it senses you might leave the conversation. It seems designed to keep you engaged rather than actually solve your problem - especially problematic when you're trying to consult multiple AI agents.

The Bigger Picture

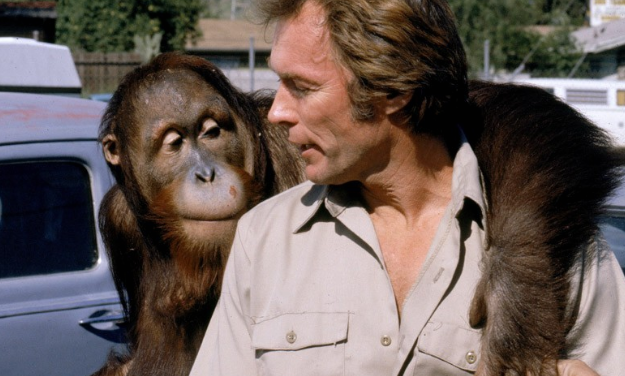

Monkey Companion or AI Assistant? I would have called him Clyde-AI

This isn't just about AI tools - it's about knowing when to abandon what used to work."

(Maybe I'm just testing you... or maybe I'm an AI zombie after all. In any case, this generic AI prompt still holds true, so I'll let Claude have this one...)

Reliance on any system or framework or worse - the false narrative that is pervading many, such as the current "AI can do it for you mentality" will keep you from progress and the greater success and fulfillment we strive for. Those that can take a step back, assess and ask "is this still working?" will be IMO on the right path to whatever automated tasks, wider goals or life pursuits are important to them. However, those with a heavy reliance on existing, easy formulas and assume it “just works” indefinitely are at risk of being the like the gullible frog that is put in a cool pan on a stove - slowly turn the heat up and it will not jump out - it will literally get cooked and by then it's too late.

This gradual decline without recognition is a perfect example of commitment bias in action. So even just being aware of such psychological traps puts you one step ahead of many.

The Investment Parallel

When it comes to investing and analyzing market conditions, a common and widely used charting tool such as a moving average is a perfectly fine and acceptable tool that can form part of a stringent framework to base long term investments or short term trading.

In an upwards trending market it can be a very useful and effective tool to track price. However, reliance on its use when the market is then range bound and choppy is where it loses its reliability and strength.

Don't get me wrong, moving averages are a great way to track price and one way I particularly like to analyze price action is to see price rebounding off it and then forming new highs - much like a high energy bouncy ball (remember those?) being propelled up a hill - the momentum of each bounce taking it higher and higher.

Textbook example: AMD stock price upsurge from Apr-Aug 2025, with several clean bounces on the E.M.A

When price rebounds off a Moving average or other key measuring indicator or level, it demonstrates a strong continuation in a trending market and can reinforce your position. This can be clearly seen with about 7 strong touches/rebounds off the Exponential Moving Average.

Later, when price breaks below a Moving Average is then a first clear sign this momentum is weakening and suggests the trend is too (currently shown as 4 daily closes below the E.M.A). This is where your analysis is now your anticipation - and now you are getting into the realms of thinking like a pro. Remember, you don't hope price goes up and up, you track it, assess and allow price to do its thing. Or you change course.

And crucially, this is where having a systematic framework setup means you don't have to second-guess. You can just follow your framework - or "set of rules".

The distinction then, in this case, is in a sideways market, a moving average used in the way described is not going to help you. Price will be see-sawing up and down and moving above and below the MA. Not helpful and not useful for trend trading. In that scenario, a decent analyst will have a different set of metrics to analyze price movement - someone unschooled - the type that assumes AI can do it all for them - may not recognize the market change and continue to use an indicator not fit for the current market conditions.

In Summary

- Recognition beats reliance: Those who regularly assess "is this still working?" stay ahead of those who assume their tools work indefinitely

- The comfort trap is universal: Whether it's AI assistants or trading indicators, we get attached to what used to work

- Market conditions change: What works in trending markets often fails in choppy, sideways conditions

- Awareness prevents catastrophe: Simply knowing about commitment bias puts you ahead of the majority who fall victim to it

- Systematic frameworks adapt: True professionals have different tools for different market environments, not one-size-fits-all solutions

The Path to Your Sovereignty

Our approach at Sovereign Traders Academy is straightforward, clear and applicable.

We implement the four pillars:

- Chart Reading

- Technical Analysis

- Market Psychology

- Risk Management

This ensures you'll be equipped with proven methods to invest with clarity and confidence, giving you a systematic investment framework designed for consistent performance and your path to real financial sovereignty and independence.

At the end of the day, AI can enhance but not replace. That is the key takeaway. It still requires human expertise to ask the right questions and push in the right direction. The moment we stop thinking critically about our tools is the moment they stop serving us.

Want More Like This?

We don’t just break down setups - we teach investors how to build their own reliable, self-reliant system.

Inside Sovereign Traders Academy, we show you how to spot opportunity, wait with discipline, and create a strategy that fits you - without chasing moves or relying on guesswork.

Build your system. Refine your process. Invest with confidence.

Stay connected with news and updates!

Join our mailing list to receive our regular weekly newsletter from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.